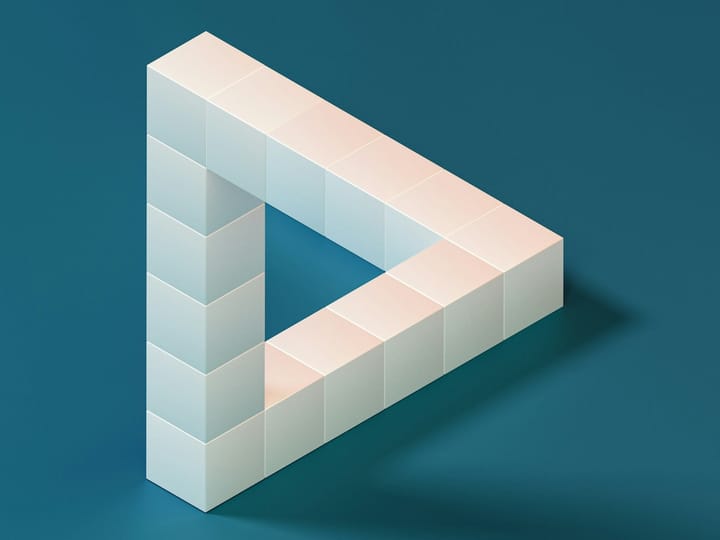

The Trust Triangle Evolution: From 3-D Secure's Three Domains to AP2's Agent Architecture

Twenty-five years ago, the payments industry solved the trust problem of e-commerce with a three-domain architecture that became the backbone of online authentication. Now, as AI agents prepare to shop on our behalf, we're witnessing history rhyme. But this time, humans might not be in the loop.