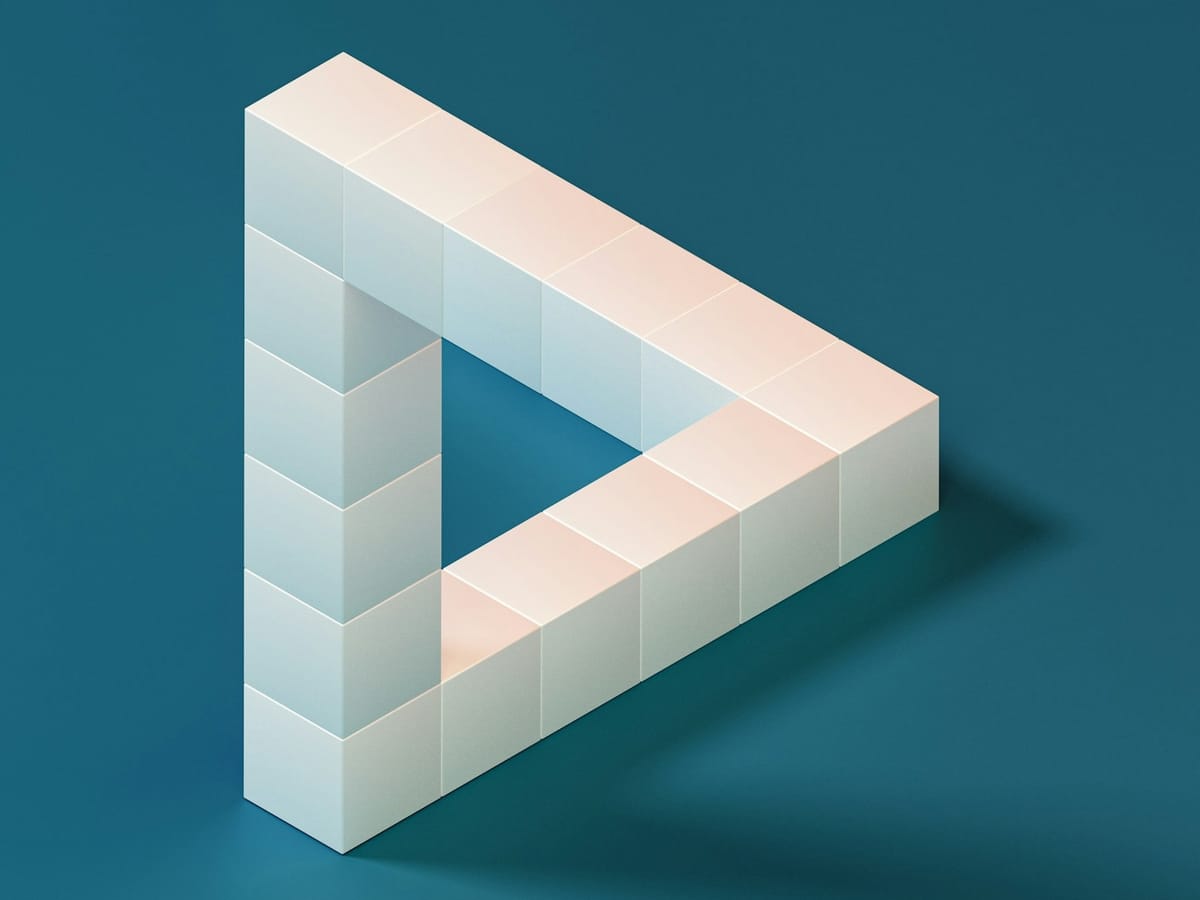

The Trust Triangle Evolution: From 3-D Secure's Three Domains to AP2's Agent Architecture

Twenty-five years ago, the payments industry solved the trust problem of e-commerce with a three-domain architecture that became the backbone of online authentication. Now, as AI agents prepare to shop on our behalf, we're witnessing history rhyme. But this time, humans might not be in the loop.

The Original Three-Domain Model

When 3-D Secure launched in 1999, it tackled a fundamental problem: how to establish trust in card-not-present transactions where the traditional security assumptions of physical commerce no longer applied. The protocol's elegant solution created three interconnected domains — issuer, acquirer, and interoperability — each playing a crucial role in authenticating transactions. Today, as AI agents prepare to transact autonomously on our behalf, Google's Agent Payments Protocol faces a strikingly similar challenge, requiring us to reimagine trust for an era where even the human isn't present.

The original 3-D Secure architecture recognised that online payments needed more than bilateral trust between buyer and seller. The issuer domain encompassed the cardholder and their issuing bank, responsible for authentication and enrolment. The acquirer domain included the merchant and their acquiring bank, initiating authentication requests and processing payments. Critically, the interoperability domain—the card schemes' infrastructure including directory servers and authentication frameworks—served as the trusted intermediary, enabling these otherwise disconnected domains to communicate securely.

Network Effects Through Interoperability

This tripartite structure solved the "stranger danger" problem of early e-commerce. Without the interoperability domain acting as a trusted broker, issuers and acquirers would have needed thousands of bilateral agreements and technical integrations. Instead, schemes like Visa's Verified by Visa and Mastercard's SecureCode provided common rails that any participant could join, creating network effects that drove adoption.

AP2 faces an evolved version of this challenge. Where 3-D Secure helped issuers answer "How do that our cardholder is shopping on a legitimate site?", AP2 must answer "How do we know this agent has legitimate authority from the user?" The protocol's solution mirrors 3-D Secure's domain thinking but adapted for agent commerce.

AP2's Reimagined Domain Architecture

In AP2's architecture, we see familiar patterns emerging. The user and their chosen AI agents form one domain, analogous to the issuer domain, where authentication and authorisation originate. Merchants and their payment processors constitute another, similar to the acquirer domain. But most intriguingly, AP2 itself, along with complementary protocols like Agent-to-Agent (A2A) and Model Context Protocol (MCP), creates a new form of interoperability domain specifically designed for agent interactions.

The parallels extend beyond structure to function. Just as 3-D Secure's Access Control Server (ACS) manages cardholder authentication within the issuer domain, AP2's verifiable credentials system creates cryptographically signed "mandates" proving user intent. Where 3-D Secure's Merchant Plug-In (MPI) initiated authentication requests from the acquirer side, AP2 enables merchants to validate agent authorities. And replacing the Directory Server's role in 3-D Secure, AP2's open protocol framework facilitates discovery and communication between diverse agent platforms and payment systems.

Learning from Two Decades of 3-D Secure

Yet AP2 also benefits from two decades of lessons learned. 3-D Secure v1's rigid authentication requirements, mostly static passwords for each transaction, taught the industry that security without usability fails. Cart abandonment rates soared as customers faced popup windows and redirects. AP2 appears designed to avoid this trap, building in flexibility from the start. Its support for multiple payment methods (initially cards, expanding to real-time payments and digital currencies) and integration with existing protocols suggests a more pragmatic approach than 3-D Secure's initially monolithic design.

The full AP2 specification on GitHub reveals careful attention to user experience considerations that 3-D Secure v1 overlooked. The protocol emphasises maintaining user control whilst minimising friction; a balance that took 3-D Secure years and a major version update to achieve.

The Critical Liability Question

The liability model presents another crucial parallel. 3-D Secure's great innovation wasn't just technical—it was the liability shift that made authenticated transactions the issuer's responsibility rather than the merchant's. This economic incentive drove adoption more than any security benefit. AP2 promises "clear transaction accountability" through its cryptographic audit trails, but the precise liability framework remains to be defined. Will agent developers bear responsibility for "hallucinated" purchases? Will users be liable for the mandates they sign? These questions echo the early days of 3-D Secure, when the industry grappled with similar ambiguities.

Industry Collaboration as Foundation

Perhaps most significantly, both protocols recognise that establishing trust in new transaction paradigms requires industry-wide collaboration. 3-D Secure succeeded because Visa, Mastercard, and eventually other schemes created compatible implementations within a common framework. AP2's launch with sixty-plus partners, including Mastercard, American Express and PayPal, suggests Google has learned this lesson well.

The interoperability domain concept may prove even more critical for agent payments than for card transactions. While 3-D Secure connected relatively homogeneous payment systems, AP2 must bridge diverse AI platforms, each with different capabilities, training, and potential failure modes. The protocol's success will depend on creating an interoperability layer robust enough to handle this complexity whilst remaining simple enough for widespread adoption.

Looking Forward: The Authentication Evolution

As payment professionals who've navigated 3-D Secure's evolution from password-heavy v1 to risk-based v2, we're watching the birth of what might become the authentication standard for the agent economy. The three-domain architecture that served us well for human-initiated transactions is being reimagined for a world where our digital representatives transact on our behalf. The question isn't whether this evolution is necessary; it's whether AP2 has learned enough from 3-D Secure's journey to get it right from the start.